Tax Implications and Accounting Tips for Small Businesses – Sole Proprietorship/Independent Contractors :

Understanding the basics of Sole Proprietorships :

- Sole Proprietorships is one of the three ways of organizing a business. The other two being Partnerships and Incorporation. There is no legal distinction between the owner and the business. The single owner is alone responsible for all liabilities of the business, but he has full decision-making power. Sole proprietor pays taxes by reporting income (or loss) on a T1 Income tax return. The tax rate is the same rate as individual’s personal tax rate.

- To know more about the definition of sole proprietorship, you can click here.

Small Business Accounting Tips :

- Open a business bank account – It is advisable to open a separate bank account in the name of your business. Keep the personal and business finances separate especially during tax filing season. It can also give us a quick glance at our business expenses. We can look for alternatives to work in a more cost-effective way. This is crucial to business expansion over the long run.

- Keep accurate records of your Income and Expenses – Record keeping and accurate accounting is crucial. Small business owners keep their own records by capturing the money coming in and the money spent for the business. They do not realize the accuracy of the profits from the business also depends on the taxes paid and saved.

- Track all business expenses – Keeping track of your expenses will ensure that you can maximize tax deductions and credits. For business related expenses, use your business bank account and business credit cards.

- Understanding cashflows – As the business grows it is pertinent to know what exactly is happening with the cash flow. Due to poor record keeping and improper accounting, we could be paying less taxes. That could lead to paying penalties in future.

- Hire a professional – Hiring a bookkeeper for record keeping can make a big difference when it comes to cash flows. Tax planning helps you save taxes strategically.

- Invoicing on time and follow up on receivables – There needs to be a proper invoicing system. Sending friendly reminders to the customers before the deadline ensures prompt payment on all the invoices.

- Budget for Tax – We might have to pay taxes at the end of the financial year. It is good to budget for this expense so that you are not massively shocked at year end.

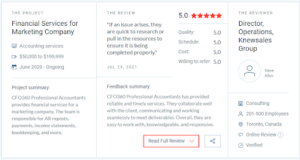

If you’re having problems managing your accounting/bookkeeping processes and taxes, we can help you! At CFO360, we provide monthly accounting/bookkeeping services to small and medium-sized businesses and their owners. Click here to learn more about what we have to offer!