9 Reasons Why Small Businesses Fail: Avoid The Potholes

As a small business owner, you are faced with many challenges. There is no one-size-fits-all solution for success. It’s important to be aware of the pitfalls that can keep your company from reaching its full potential. Here are 9 common reasons why small businesses fail that we’ve come across often and what you can do about them!

9 common reasons why small businesses fail:

1. Lack of a Clear Vision or Focus

This is the most common reason why small businesses fail. Without a clear vision, it’s difficult to know what you’re working towards and how your company will be different from competitors. You need to have something extra to offer in order for clients to want to work with you rather than someone else who offers similar services at lower prices.

One of the symptoms of lack of vision for your small business is that it goes from idea to idea without focus. This is a quick way to burn out and lose steam.

What should you do? You need to have a clear vision for your company. This is not to say that your vision cannot evolve but some of the most successful businesses focused on the same thing for multiple decades only to be declared an overnight success.

2. Poor Financial Management

Another common pitfall is poor financial management. This can be due in part because they are not educated about how money works or have a lackadaisical attitude towards it and their company’s bottom line suffers as result. As Accountants, we deal with financial management and accounting services on a daily basis and often deal with the fallout and help clients understand the unnecessary cost of not doing this or not doing it early enough in the life of their business.

What should you do? If you’re comfortable doing this yourself then make it a priority. If not, then get the right team on your side to deal with this. We also have a financial statement template for your small business should it be too early for you to hire someone to keep track of your finances.

3. Poor Marketing Strategy or Execution

Many of the small businesses we work with come from a technical background. They know their skill or product extremely well but have never had to sell it.

This is a common pitfall because it’s difficult for someone who has never had any experience in this area and doesn’t know what works or how much money should be spent on advertising, etc. Selling and advertising can also be a difficult skill to learn and doesn’t necessarily come easily to many new small business owners.

What should you do? There are no easy answers here, but you should give this area enough attention. You may need to hire a professional or consult with someone who has experience in digital marketing services. Do some research on what works for other businesses like yours and start experimenting in this area of your business.

4. Risks, Risks, everywhere!

Business is inherently risky, small business doubly so. We’ve come across many a business too reliant on one client or one supplier or even one key staff member. The best way to reduce risk is by diversifying your business. This means not putting all of the eggs in one basket. If you have a successful product or service then it’s important that this success doesn’t become too dependent on any single customer and/or market sector. (E-commerce businesses are particularly vulnerable).

Risk is everywhere in the business. It’s only by being aware of this and on the lookout for business risks that you can start mitigating them and increasing the odds of your small business succeeding.

5. Inability to adapt to change

If COVID19 has shown us anything it’s that you need the ability to make rapid changes in your life on a dime. The world is always changing and so are the needs of your customers. You need to be able to change or you’ll find yourself left behind like these 50 organisations that failed to innovate. The best way not only to survive but thrive when faced with rapid changes like this? Keeping your small business lean and ready to change in no time!

6. Unrealistic expectations for growth and profits

Most people underestimate the value of compound growth. Going for the small weekly goals can help you reach large goals really quickly. Over a number of years, this growth can add up to a very large number. But many new small business owners often walk in with the expectation of hitting that number within an unrealistic time period. Don’t believe us? Netflix has a service/product at an average cost of less than $10 per month (depending on the country). Their revenue has grown exponentially from $682 million annually to over $24 billion annually. Good things take time.

7. Lack of knowledge or skills needed in the industry

This is a big one. A lot of people are starting their own business because they have an idea that’s never been done before and it seems like the perfect opportunity to make some money. Often these businesses fail due in large part to not having any knowledge or skills needed for success within this industry. If, for instance, you want to change the music industry, make sure you understand that current industry from the bottom up first. There is value in being a novice in some arena’s but you may find that you’re rediscovering the same problem industry veterans have known for years.

8. Failure to build relationships with customers, suppliers, and employees

The best customers refer your small business at every opportunity. Good employees help make everyone around them more productive. The best suppliers always give you the deal first. In part all three of these are because of relationships.

Relationships are the key to success in any business. They’re also one of those things that you can’t buy or sell, but only build over time with hard work and dedication . Relationship building is a skill set all on its own – it’s not something everyone has an aptitude for so if this doesn’t come naturally then make sure your employees have these skills as well! If they don’t, hire someone who does! This will be worth their salary many times more than what other companies might pay them because relationships lead directly into profitability which leads back again…to relationship-building (and repeat).

9. No Financial Cushion

In his autobiography, Shoe Dog, Phil Knight talks of Nike constantly being on the brink of financial implosion by having excessive leverage, especially during the early years. Phil Knight could clearly handle that level of stress but it may also be that he got lucky. The Survivorship Bias teaches us that for every Phil Knight that got it right, there may well be many that did not. Maintaining a financial cushion is the best way to ensure that your small business does not fail, and to ensure you sleep a bit more soundly at night.

Running a Small Business is a constant reel of problems that need to be solved. The best we can do is to learn as much as we can and share what we’ve learnt. And the more we share, hopefully, the less small businesses will fail!

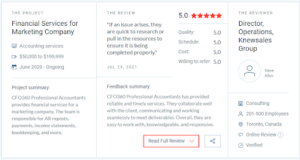

If you’re having problems managing your accounting/bookkeeping processes and taxes, we can help you! At CFO360, we provide monthly accounting/bookkeeping services to small and medium-sized businesses and their owners. Click here to learn more about what we have to offer!

About the Author: CFO360 offers comprehensive solutions to simplify matters for your company. Services range from accounting systems and monthly bookkeeping to tax preparation services. Led by Professional Accountants and servicing hundreds of small businesses. They’ve dealt with many small businesses going through a difficult period.